Members of APROCASSI, a coffee cooperative in Peru, line up to apply for credit from the cooperative’s internal credit fund.

When asked about the effect that a rural business’ internal credit fund has on farmers, Root Capital advisor Fany Murillo answers with a single word: “epic.”

Earning between two and six dollars a day, smallholder farmers in the areas where we work often can’t afford to buy necessary farming inputs like fertilizer or drought-resistant seeds, replace their aging, disease-prone crops with healthy ones, or build the savings to weather a poor harvest. In response to these challenges, many of the agricultural businesses we work with have formed internal credit funds — essentially small in-house banks that use the business’ own staff and revenue to lend small amounts of capital to farmers. Root Capital’s advisory team trains businesses on the effective implementation of internal credit funds as part of our suite of services, making sure they can bring essential financial services to farmers who can’t get them anywhere else.

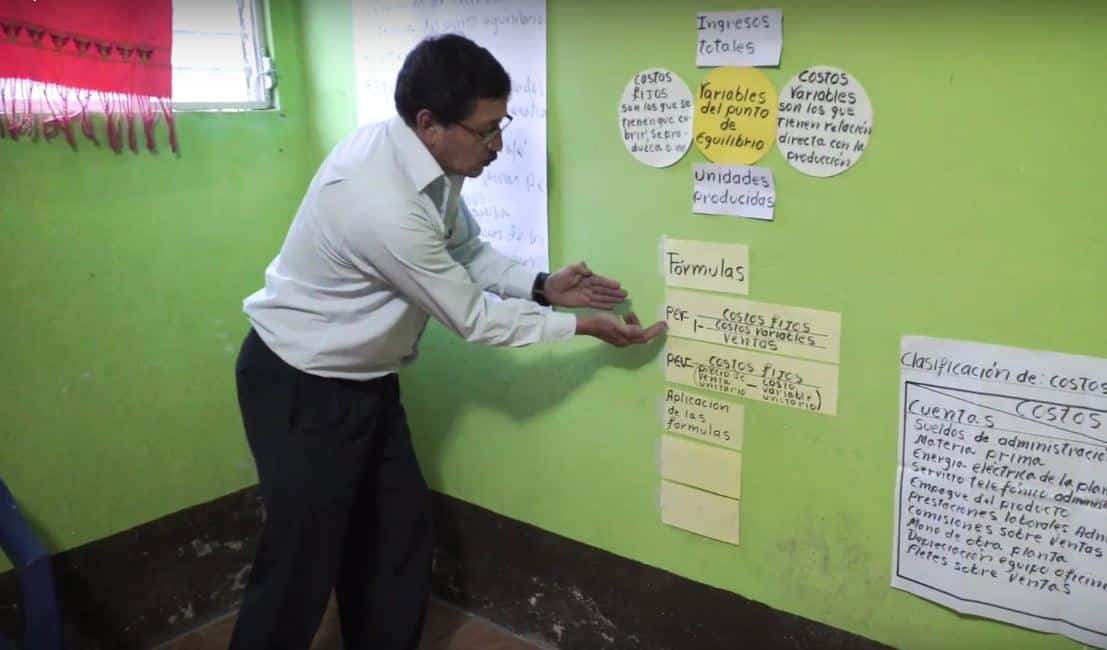

Root Capital advisor Gildardo Martínez leads a workshop on internal credit fund management.

Many rural businesses find themselves unable to unlock the full potential of internal credit funds: they lack either the resources to offer loans to borrowers, the human capital to run such a fund effectively, or simply the know-how to run a lending facility. Aracelly Avendaño, credit officer at our client COSATIN, puts it simply: “We had the knowledge. We just weren’t doing it in the best way.”

In response, we’ve made training in essential fund management skills a core focus of our advisory services. Our advisory team runs on-site workshops to train cooperative management and staff in the foundations of fund management, ranging from credit regulation and development to accounting and internal controls. At the end of their training, our clients walk away with an easy-to-follow manual and an overhauled and much simpler system for disbursing credit to borrowers.

For Asociación Chajulense, a cooperative of mostly indigenous coffee farmers and weavers in the highlands of Guatemala that we’ve worked with since 2006, Root Capital’s advisory services have been crucial for their credit fund’s success. Since we began working with the cooperative in 2006, Root Capital has offered the cooperative a series of trainings on internal credit fund management. Now, says Asociación Chajulense’s credit portfolio coordinator Adin Teyo, “our fund is more structured. We have a better record of operations. We’re better supported. And we can make decisions based on policy, rather than on the fly.”

A street scene in Chajul, Guatemala, where Asociación Chajulense is located. © Sean Hawkey

In the end, however, it’s not just the business that benefits from Root Capital’s advisory trainings — it’s individual farmers, artisans, and rural entrepreneurs. Rural businesses understand their communities better than any bank could, and can design stronger, more suitable loan products as a result. These products – generally short- and long-term microloans – allow farmers to launch side businesses in the leaner months that can generate income or promote food security.

Asociación Chajulense is a perfect example. Supported by our advisory team, their internal credit fund currently offers their members a few different types of financial services. Their short-term loans allow coffee farmers to purchase fertilizer or farming inputs in advance of the planting season, or let women weavers purchase their materials on credit and pay the cooperative back once they sell their final products. Longer-term loans enable their members to make more substantial investments in the productivity of their farms, such as replacing diseased or aging coffee trees over the course of several years. Juana Hu, general coordinator of Asociación Chajulense’s women’s organization, notes another, deeper benefit: after applying the knowledge gleaned from Root Capital’s training, she stated, “we’ve seen what we can achieve as women… and much more.”

An artisan member of Asociación Chajulense proudly displays a coat she’s made.

When we provide employees of rural businesses with the training they need to manage internal credit funds responsibly, both the enterprise and its producers reap the rewards. Indeed, states Asociación Chajulense’s credit promoter Manuela Tomo, “We’ve been able to recognize the areas where we were weaker, and improve. Now, we’re serving people better than we were before.”

Root Capital’s advisory services — including training on internal credit fund management — are made possible by the philanthropic contributions of supporters like you. Please consider making a donation to Root Capital, and join us in strengthening rural businesses like Asociación Chajulense.

{{cta(‘2d1cbb79-4fea-4ad3-b572-e85b8d91d19d’)}}