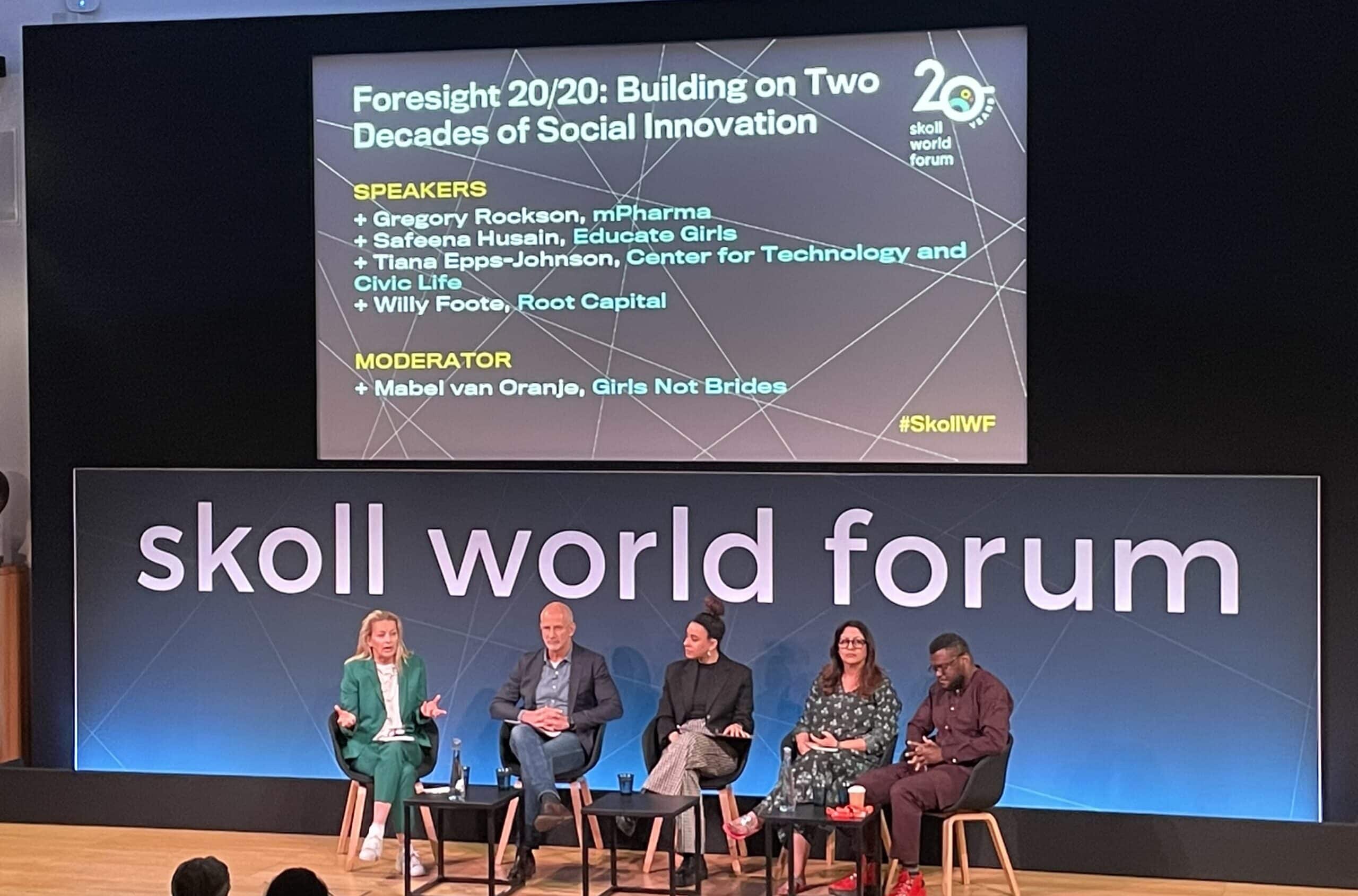

Pictured from left: Mabel van Oranje from Girls Not Brides, Root Capital Founder and CEO Willy Foote, Tiana Epps-Johnson from the Center for Technology and Civic Life, Safeena Husain from Educate Girls, and Gregory Rockson from mPharma at the Skoll World Forum.

“In Sub-Saharan Africa today, the ‘missing middle’ financing gap for agricultural small and medium enterprises (agri-SMEs) is $65 billion a year.”-Root Capital’s CEO and founder Willy Foote at the 20th Skoll World Forum in Oxford, England, speaking on the ever-widening financing gap that exists for agribusinesses in developing economies.

This persistent financing gap has been the focus of Root Capital’s work for the past 24 years. Early on as an organization, we recognized the deep social challenge of the massive “missing middle” between agricultural enterprises considered too large for microfinance and too risky to secure credit from conventional commercial banks. And we’ve made it our mission as a nonprofit social enterprise to try to address this challenge.

In mid-April, Willy joined a panel of social innovators at the Skoll World Forum to share Root Capital’s learnings from more than 20 years of empowering agricultural enterprises via capital and capacity-building support. He highlighted four key areas of focus that have enabled our long track record of success as an organization supporting the “missing middle” and achieving impact in agricultural communities:

- Maintaining a fierce focus on our core partners: our clients. We have targeted our innovation on partnering with small, growing agricultural businesses because they are both engines of impact and proximate actors that are deeply rooted in their local communities. And we have shaped our organizational strategy and evolved our products by listening to and responding to these agribusinesses’ needs. During the COVID-19 pandemic, for example, we surveyed our clients and adapted our programming accordingly-using resilience grants to finance the distribution of personal protective equipment and other emergency programs.

- Crowding in an ecosystem of like-minded actors: Our ultimate goal is the replication and adaptation of our work – the enormous scale of the financing gap means it’s critical to get other institutions and practitioners involved to reach scale. For example, in 2012, Root Capital became a founding member of the Council on Smallholder Agricultural Finance (CSAF), an alliance of social lenders formed to exchange learning, identify best practices, and develop industry standards. We have also built a sector-wide evidence base and platforms of collaboration to share our successes and learnings.

- Pioneering the blended finance model: We brought philanthropy, impact investing, guarantees, and public-private partnerships together to absorb the risk of lending to small and growing agricultural enterprises. Philanthropic capital also subsidizes the critical learning, research, and development needed to prove the impact case and crowd more lenders into the agricultural finance marketplace. Through the use of blended capital from various sources, we’ve been able to achieve transformational impact-unlocking capital flows to emerging markets, countries, and value chains that have historically been left out.

- Pushing the innovation frontier: We realized that we had to focus on reaching businesses that would not otherwise have access to financing from commercial or social lenders in order to stay ahead of the curve. Over time, we’ve learned to cultivate a delicate balance between staying light-footed and nimble through diversification, while also being cautious not to overextend ourselves.

Willy also emphasized the importance of resilience-for Root Capital’s clients, but also for Root as an organization. To ensure long-lasting organizational durability, Root Capital is investing more and more in its staff and infrastructure.

Willy closed by putting Root Capital’s work into context against the backdrop of the climate crisis. He explained that as a blended finance nonprofit social enterprise, we need to be able to absorb the risk that comes with creating practical, scalable pathways for climate resilience; and the urgency of the climate crisis requires directing resources to the frontline agricultural communities most affected by climate change. Willy concluded with a call to action for other practitioners and institutions: join Root Capital in the blended finance movement and work collaboratively to tackle these global challenges.

Watch the full panel discussion, “Foresight 20/20: Building on Two Decades of Social Innovation,” below.